How we Invest

Palisade’s investment strategy is guided by the following four principles:

”The individual investor should not underestimate the long-run risk of not owning enough equities.

Charles D. EllisAuthor, "Winning the Loser's Game: Timeless Strategies for Successful Investing"

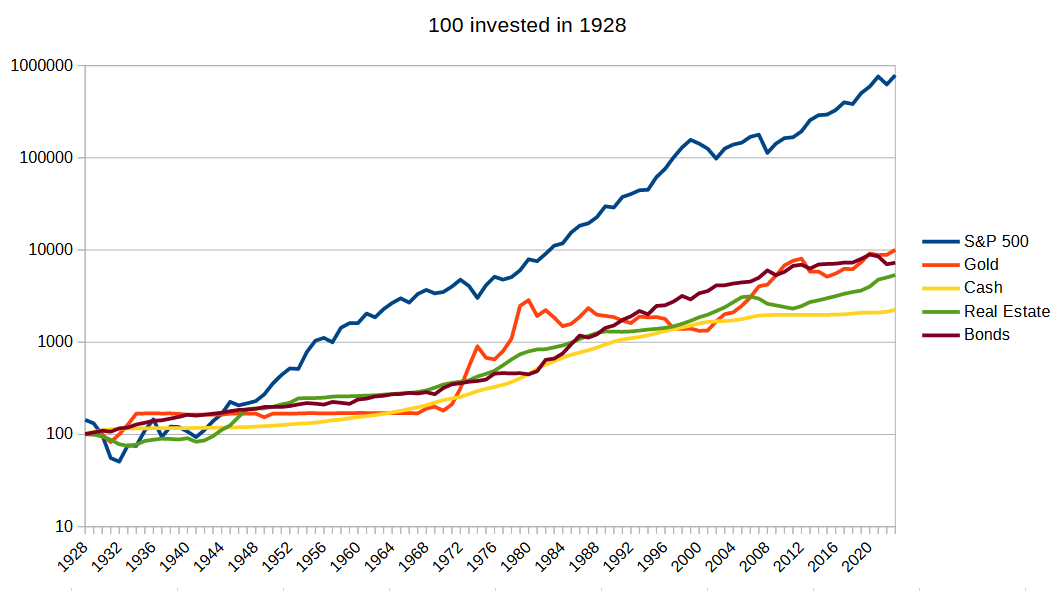

Palisade allocates its client portfolios heavily towards stocks due to their superior historical returns. No other asset class (bonds, cash, gold, real estate, etc) has come close to delivering the long-term historical returns of publicly traded equities.

Image source: Quantified Strategies

This strategy requires discipline and patience to weather short-term market volatility, something that is often hard for investors to do on their own.

Bonds form an important part of the portfolio for many investors, reducing volatility in the short term. However, a portfolio too heavy in bonds can significantly hamper long-term growth. Many advisors over-allocate to bonds to reduce volatility (often defaulting their clients into 60/40 stock/bond portfolio), but in doing so they give up significant returns in the medium to long term:

Data source: Financial Samurai

Palisade builds portfolios with appropriate bond allocations for the client’s situation, especially to cover anticipated expenditures over the next several years, but avoids heavy bond allocations that would significantly reduce the client’s likelihood of achieving their long-term financial goals.

”Patient stock investors who can see past the scary headlines have always outperformed those who flee to bonds or other assets.

Jeremy SiegelAuthor, "Stocks for the Long Run"

”Time in the market beats timing the market.

Kenneth FisherFounder of Fisher Investments

Palisade maintains that the best way to weather the short-term volatility of the market is to remain invested for the long term. Our goal is to help our clients stay appropriately invested when everyone else is pulling out and locking in their losses.

This can be quite challenging when the markets are down, but it is helpful to remember that for a well diversified portfolio, the probability of a profitable return is directly correlated with holding period. As shown in the table below, the historical odds of a positive return increase dramatically as the holding period increases, with the S&P 500 having been profitable over every 20 yr period in history:

Data source: Motley Fool Investing

Another way to get an intuitive sense of this is to look at the range of historical market returns (the best and worst returns) for various holding periods. The chart below shows that from 1950-2025, stocks have had annual returns ranging from 61% at the high end down to -43% at the low end (gulp!). But those wild fluctuations attenuate as holding period increases, with the lowest return for any five yr holding period being -7%, and the lowest returns for any 20 yr holding period being a positive 4%.

Image source: JP Morgan Asset Management

”The stock market is a device for transferring money from the impatient to the patient.

Warren BuffetChairman and CEO of Berkshire Hathaway

Comprehensive Diversification

Minimizing concentration risk in any one company, industry or geography

”Diversification is the only free lunch in investing.

Harry MarkowitzFather of Modern Portfolio Theory

Palisade systematically diversifies its client portfolios across all industries, capitalizations and geographies. Palisade’s goal is to capture the market return, which can only be achieved by owning the market.

In contrast, many investors and advisors attempt to beat the market by picking certain companies, industries or strategies to bet on, either directly or by investing in actively managed funds that do the same. Research has shown that, on average, this type of active management – attempting to pick outperforming investments – trails the comparable benchmark return significantly, especially after fees are considered:

- S&P’s SPIVA Scorecard has concluded that relatively few active managers are able to outperform passive managers over any given time period, either short-term or long-term. For example, for the 15 years through Dec 2024, 89.5% of actively managed large-cap funds underperformed the S&P 500.

- Morningstar’s Active/Passive Barometer concluded that actively-managed funds’ long-term record against their passive peers is quite bleak, with a mere 21% of active strategies beating their passive counterparts over the 10 years through June 2025.

–

The chart below shows the relative return of the eleven industry sectors of the US economy from 2010 to 2024. It illustrates the folly of betting on certain industries, underlining the fact that there is no one industry that reliably outperforms any other industry:

Image source: Novel Investor

Another common bias in advisor portfolios is an overweight to domestic markets and neglecting to diversify internationally. While domestic markets have outperformed international markets in recent years, there have been long periods of international outperformance, as shown below:

Image source: Hartford Funds

Palisade’s goal is not to try to anticipate whether domestic or international markets will outperform in the future, but rather diversify across both to capture the return of the global stock market and minimize the concentrated risk of any single geography. This reduces the overall volatility of our client portfolios.

”Don't look for the needle in the haystack. Just buy the haystack!

John BogleFounder of the Vanguard Group

”It's not how much money you make, but how much money you keep, how hard it works for you.

Robert KiyosakiAuthor, "Rich Dad, Poor Dad"

Many advisors spend a lot of time trying to control what is inherently out of their control (market returns), but very little time controlling something that is often well within their control: the taxes and fees their clients will pay on their investments over the course of their lifetimes.

Palisade considers this a core fiduciary responsibility, and seeks to maximize clients’ after-tax, after-expense returns. From a tax standpoint, Palisade seeks to minimize the tax consequences of every action they take in their client portfolios, via:

Tax-advantaged Accumulation

Tax-efficient Asset Location

Tax-aware Trading

Tax Loss Harvesting

Tax-saavy Planning

Tax-conscious Withdrawals

Tax-advantaged Donations

Various research studies have shown that a tax-aware advisor can have a significant impact on their client’s after-tax returns:

- Vanguard research estimates that tax-aware advisors could potentially add up to 1.5% in additional returns via tax loss harvesting, up to 1% additional returns via tax-efficient retirement strategies (Roth conversions, strategic withdrawals, etc), and up to 0.6% additional returns via asset location strategies. (Separate research from Vanguard estimated that asset location strategies improved returns between 0.05% and 0.30% per year.)

- Envestnet research estimates that tax optimization strategies can add approximately 1% of annual value when compared to an investment strategy that is not actively tax managed.

- The above estimates fall roughly in line with our own research and experience, with one major exception. Because of our unique tax strategies, the tax savings become significantly larger for our clients who make charitable donations, including donations to religious, educational, or any other charitable institutions.

–

With regard to expenses, because the fees of various investment products are not always transparent or easily comparable, it is common for investors to find themselves in investments that have high fees, loads, or annual expenses.

Unfortunately, it is not uncommon for advisors to recommend such investments, either because they are pursuing active investment strategies (which have inherently higher fees), or because they receive commissions from the investments they recommend (commissions are paid from fees).

In contrast, because Palisade does not accept commission from third parties (such as mutual fund providers or insurance companies) and is focused on passive investment products, it is able to employ investments with very low costs, saving our clients money and improving their investment returns.

”The miracle of compounding returns is overwhelmed by the tyranny of compounding costs. Fund performance comes and goes. Costs go on forever.

John BogleFounder of the Vanguard Group