Most of us are reasonably good at living within our means, which just means that our income exceeds our daily living expenses. Over time, however, this excess income can pile up, often in accounts that are less than ideal. This is not by design – we simply neglected to map out where this excess income should ideally go. Maybe we opted into our company’s 401k plan, but that’s about as far as we got.

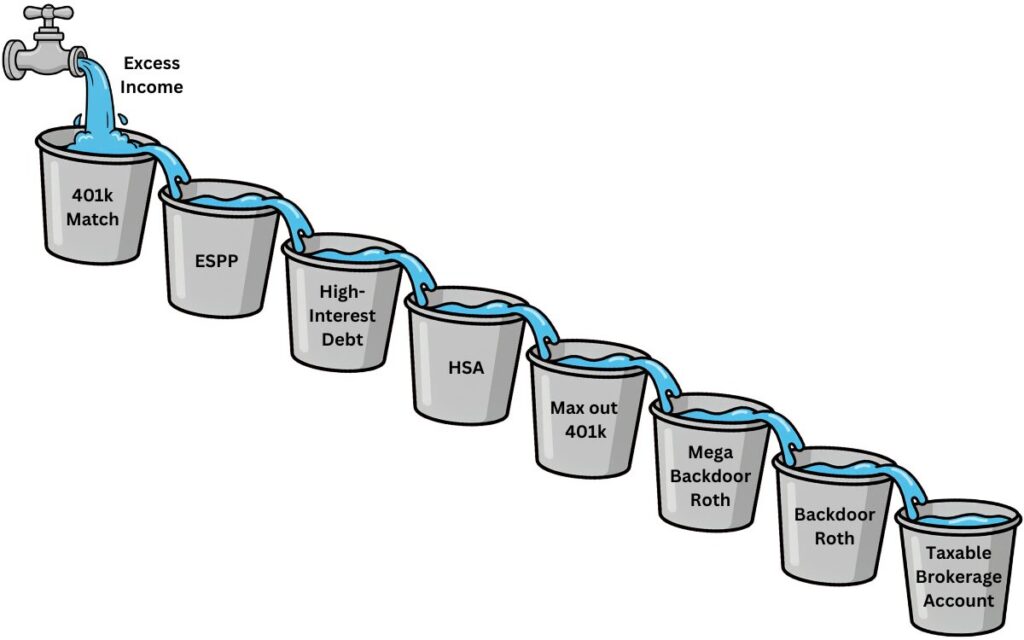

Excess income is a great problem to have! And thankfully, there is a great solution. In fact, generally speaking, there is an ideal way to route excess income to maximize long-term savings. You can think of this path as a series of buckets, each representing a place to store excess income. Once a bucket fills up with excess income, it spills over into the next bucket, and so on until the last bucket.

The first step is figuring out roughly how much excess income you have, or how much you would like to set aside each month for long-term savings. Then you route that income to each bucket, in order: once the first bucket is full, you move on to the second one, and so forth.

First, Some Caveats

The bucket strategy outlined below is based on a few assumptions that need to be kept in mind:

- Most of the buckets in the list are only available to people who are currently employed. If your excess income is derived from other sources (rental income, business income, investment income, etc), some buckets will not be available to you, or there may be other buckets you can take advantage of.

- The strategy outlined below is primarily for those with significant amounts of excess income, typically high income earners. For high income earners, certain investment options are either not advisable or off the table entirely. In particular, the strategy below assumes that:

- Direct Roth contributions (either into a Roth 401k or Roth IRA) are either inadvisable, due to the high marginal tax bracket of the investor, or impossible, due to income limits on direct Roth IRA contributions (likely both).

- Direct traditional IRA contributions are inadvisable due to income limits on the deductibility of contributions (assuming you or your spouse are covered by a workplace retirement plan).

- While the strategy outlined below might be well suited for many people, there are people with unusual or unique situations that would call for this strategy to be adjusted or even abandoned altogether. The strategy is not designed to cover every possible situation or circumstance, and should not replace the advice of a competent professional.

With those caveats out of the way, let’s jump in!

🪣 Bucket #1: Secure the match on your employer-sponsored retirement plan

Benefit | Provides an immediate, guaranteed return on investment, often 50% or 100%. Both the employee’s contribution and the employer’s match are tax-deferred2. |

Availability | Only available if your employer offers a retirement plan with a matching contribution. |

Contribution Limit | Varies by employer, but the match is often around 3-6% of your salary. |

Employer-sponsored retirement plans often come with a match to incentivize you to set aside money for retirement. You secure the full match by deferring that amount of your salary into the retirement plan. The match is “free money” since it is a guaranteed return on investment (your contribution).

For example, if your salary is $100k/yr and your employer’s match is 5%, you would defer 5% of your salary into the plan ($5k), and your employer would match it by contributing an additional 5% ($5k) into your plan, resulting in a combined contribution of $10k. You’ve now saved 10% of your salary for retirement, at a cost of only 5% of your salary, a 100% return on your investment.

If you’ve secured whatever match your employer offers, time to move onto the next bucket.

🪣 Bucket #2: Max out your Employee Stock Purchase Plan (ESPP)

Benefit | Provides a significant, immediate and low risk return, typically 17.6% pre-tax for plans that offer a 15% discount, and potentially higher if the plan has a lookback provision (assuming your shares are sold immediately upon purchase). |

Availability | Only available if your employer offers an ESPP, and generally only worth it if that ESPP has certain features as outlined below. |

Contribution Limit | The IRS limits ESPP purchases to $25k of stock per year, but typically the employer will implement some lower cap on ESPP payroll contributions (e.g., 5% of your pay) |

An ESPP can be a fantastic way to invest excess income, assuming it comes with:

- A discount and/or lookback provision (ideally both), allowing you to purchase the stock below market value.

- No mandatory holding period, allowing you to sell the stock immediately upon purchase to secure the discount.

Such an ESPP allows you to purchase company stock at a discount (typically 15%), which you can then immediately sell at fair market value and pocket the discount (after taxes). Your contribution is deducted from your paycheck over the offering period (typically 6 months), after which the company stock is purchased at the discount price. You can then immediately sell the shares at full market value, returning your original contribution along with a tidy profit.

Used in this way, an ESPP is not really a place to accumulate excess income, but it does require setting aside a portion of your paycheck over the duration of the offering period. While you can hold onto your ESPP shares, doing so is not recommended as it increases your concentration risk and decreases the certainty of securing the discount.

If you’ve maxed out your ESPP participation and still have excess income to invest, time to move onto the next bucket.

🪣 Bucket #3: Pay off any outstanding high-interest debt

Benefit | Provides a guaranteed return equivalent to the interest rate on the debt. |

Availability | Must have outstanding high-interest debt to pay off. |

Contribution Limit | The cumulative sum of any high-interest debt you have accumulated. |

While it is somewhat counterintuitive to think of high-interest debt as a place to “store” excess income, the benefit of paying down such debt is mathematically equivalent to depositing that money in a savings account that pays the same interest. For example, paying off a credit card with a 15% interest rate is equivalent to earning a 15% return on an investment. And because there is no risk involved with paying off debt, that return is guaranteed!

What constitutes high-interest debt? Any liability with a double-digit interest rate is often considered high-interest debt. Examples of debt that frequently fall into this category include credit cards, payday loans, car loans, and personal loans. Note: if the interest rate is extremely high (20% or more), this bucket should probably come before enrolling in an ESPP plan. But you should always get your 401k match!

Once you’ve paid off any high-interest debt, it’s time to move onto the next bucket.

🪣 Bucket #4: Max out your Health Savings Account (HSA)

Benefit | |

Availability | Only available if you are enrolled in a high-deductible health plan (HDHP). |

Contribution Limit | For 2025, $4300 if your HDHP only covers you, or $8550 if your HDHP covers your family. |

Utilizing an HSA is a bit complicated as it requires enrollment in a HDHP1, which may or may not make sense for your situation. But if you choose to enroll in a HDHP, an HSA can be an excellent option for storing excess income.

HSAs are the only tax-advantaged account that is “triple tax advantaged,” meaning they offer tax-deductible contributions, tax-deferred growth, and tax-free withdrawals as long as they are used for qualified medical expenses. While you can pay for annual medical expenses from the HSA, many investors choose to leave the funds to grow in the HSA untaxed, under the assumption that they will have plenty of medical expenses later in life on which to spend the funds. (Some investors even keep records of all of their medical expenses over the years, so they can reimburse themselves from the HSA down the road.)

But HSAs aren’t for everyone. In addition to requiring a HDHP, they involve a bit more administrative overhead, including possibly paying for ongoing medical expenses out of pocket. If you’ve maxed out your HSA contribution (or decided it isn’t for you), time to move onto the next bucket.

🪣 Bucket #5: Max out your employer-sponsored retirement plan

Benefit | Maximizes your tax-deductible contributions and tax-deferred growth. |

Availability | Only available if your employer sponsors a retirement plan. |

Contribution Limit | Limits are adjusted periodically by the IRS, but typically fall between $17k to $70k depending on the plan type and the participant’s age. |

People who contribute enough to their workplace retirement plan to secure the match (bucket #1 above) often don’t realize that they can continue to contribute more to their plan, up to the federal contribution limit. If they have enough excess income to do so, this can massively boost their retirement savings since the contributions are generally tax-deferred2. All you need to do is increase your contributions beyond the match, ideally up to the annual limit.

Once you’ve maxed out your employer-sponsored retirement plan contributions to the federal limit, time to move onto the next bucket.

🪣 Bucket #6: Execute a Mega Backdoor Roth Conversion (MBDR)

Benefit | Allows high income earners to make sizable Roth contributions (which grow tax-free and can be withdrawn tax-free). |

Availability | Only available if your workplace retirement plan supports MBDR conversions (see below). |

Contribution Limit | Typically in the $35k-45k range, based on the overall annual 401k limit (currently $70k for 2025 if under age 50) minus your combined elective deferrals and your employer’s contributions (match plus profit sharing). |

High income earners are often ineligible to make direct Roth IRA contributions due to IRS income limits. However, if their employer’s retirement plan allows for it, they can still get money into a Roth account by executing a mega backdoor Roth conversion (MBDR). To perform an MBDR, the employer’s plan must offer two specific features:

- Voluntary after-tax contributions, allowing the employee to contribute post-tax dollars beyond their elective deferral limit (bucket #5).

- In-service distributions OR in-plan Roth conversions, both of which allow the employee to convert their post-tax contributions into Roth accounts. This conversion should happen immediately after step 1 to maximize the tax-free growth of the contribution.

Once you’ve made the largest MBDR conversion you are able to (or confirmed that your employer doesn’t support them), time to move onto the next bucket.

🪣 Bucket #7: Execute a Backdoor Roth Conversion (BDR)

Benefit | Allows high income earners to make Roth contributions (which grow tax-free and can be withdrawn tax-free). |

Availability | Only available to high-income earners who are barred from direct Roth IRA contributions, and have low existing pre-tax funds in a Traditional, SEP, or SIMPLE IRA. |

Contribution Limit | $7k for 2025 ($8k if age 50 or older) |

Another way for high-income earners to make Roth IRA contributions is by executing a backdoor Roth conversion (BDR). While the total contribution amount is smaller than a MBDR, the BDR does not depend on your employer’s retirement plan having certain features. However, because of how BDR conversions are taxed, they are most effective when your total non-Roth IRA balance is small.

To execute a BDR conversion, after confirming you don’t have significant non-Roth IRA funds, do the following:

- Fund a traditional IRA by making a nondeductible (after-tax) contribution up to the annual limit.

- Convert the newly contributed funds over to a Roth IRA.

Once you’ve executed the largest BDR conversion you are able to (or confirmed that it does not make sense due to significant non-Roth IRA balances), time to move onto the next bucket.

🪣 Bucket #8: Deposit remaining excess income in a taxable brokerage account

Benefit | Ultimate flexibility on the amount of funds that can be invested, when they can be withdrawn, and what they can be spent on. |

Availability | Available to everyone. |

Contribution Limit | No limits. |

What the taxable brokerage account lacks in tax advantages, it makes up for in flexibility: it has none of the many restrictions that constrain tax-advantaged accounts. You can contribute as much as you want, whenever you want, and withdraw funds whenever you want, for whatever you want.

And while taxable brokerage accounts don’t come with built-in tax advantages, Palisade’s investment strategy is specifically designed to minimize the tax exposure inherent in taxable accounts. Through tax-aware investment strategies like tax loss harvesting, tax-efficient asset location, tax-aware trading and tax-conscious withdrawals, we can often make a taxable brokerage account mimic the tax advantages of retirement accounts.

Also note that since most retirement assets are inaccessible until age 59.5, it is advisable to have at least some savings accessible in taxable accounts, for emergencies or other unanticipated expenses. And for those who are saving for a down payment or other anticipated large expense, the taxable brokerage account is likely the most sensible place to accumulate those funds.

Now, a Word of Caution

The strategy outlined above is somewhat idealized, and almost no one will be able to take maximum advantage of all the buckets. That could be because your employer doesn’t offer the right options, your excess income isn’t substantial enough to fill all the buckets, or simply because the bucket isn’t a good fit for your specific situation.

While we hope the list provides some guidance to those who can take advantage of it, no investor should feel like they need to utilize every bucket on the list, or feel bad if they are prevented from doing so. As always, your Palisade advisor is happy to discuss how to apply this strategy to your particular situation, and help you execute on a saving plan that is right for you.